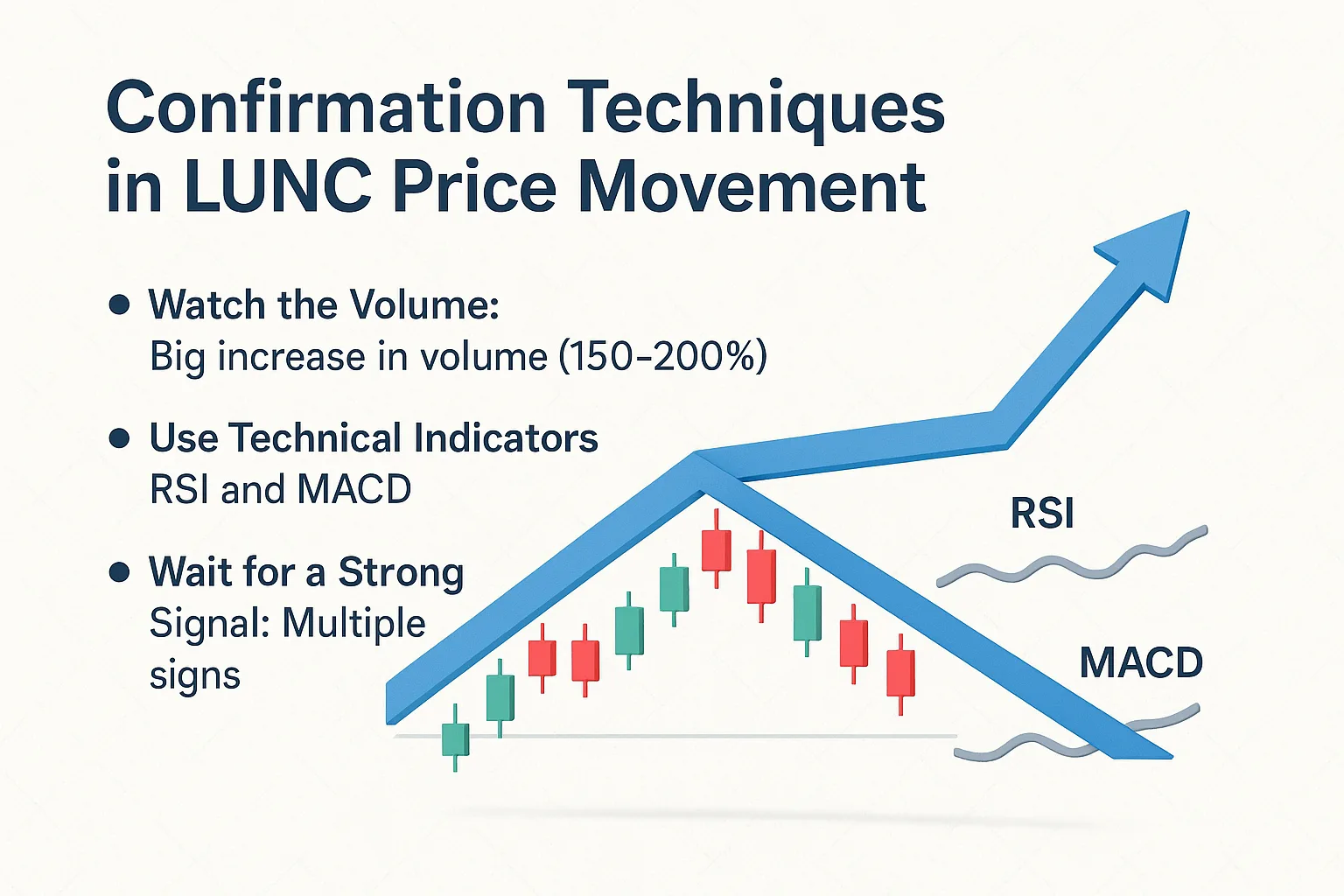

If you’re new to trading Terra Luna Classic (LUNC), it’s important to know that a breakout alone doesn’t always mean a strong price move. A breakout happens when the price moves sharply above or below a pattern, like a triangle. But not every breakout leads to a new trend. That’s why we use confirmation techniques to make sure the move is real and not a false signal.

1. Watch the Volume

Volume means the number of coins being traded. When the price breaks out, you should see a big increase in volume—usually 150 to 200 percent more than normal. This shows that many traders support the move, which makes it more likely to continue. If the volume is low during a breakout, it may not last long and could reverse quickly.

2. Use Technical Indicators

Two common tools are RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence). These indicators help you understand market momentum.

RSI shows if a coin is overbought or oversold. A reading near 50 means the market is balanced. If it moves above 60 after a breakout, that’s a good sign the uptrend may be real.

MACD helps show the direction of the trend. If it starts rising and crosses its signal line after a breakout, it can confirm the upward move.

3. Wait for a Strong Signal

A safe strategy is to wait for multiple signs. For example, if the price breaks above a triangle, volume increases, and the RSI starts rising, that gives more confidence in the trend. Don’t rush into trades just because the price moves a little. Waiting for confirmation helps reduce mistakes, especially for beginners.

In short, confirmation techniques help you avoid false breakouts and trade with more confidence. Always look for volume and check indicators like RSI and MACD before making decisions.