Concept by RedlineDrifter & REDniks. Link to complete Whitepaper: www.ustprotocol.com

Overview:

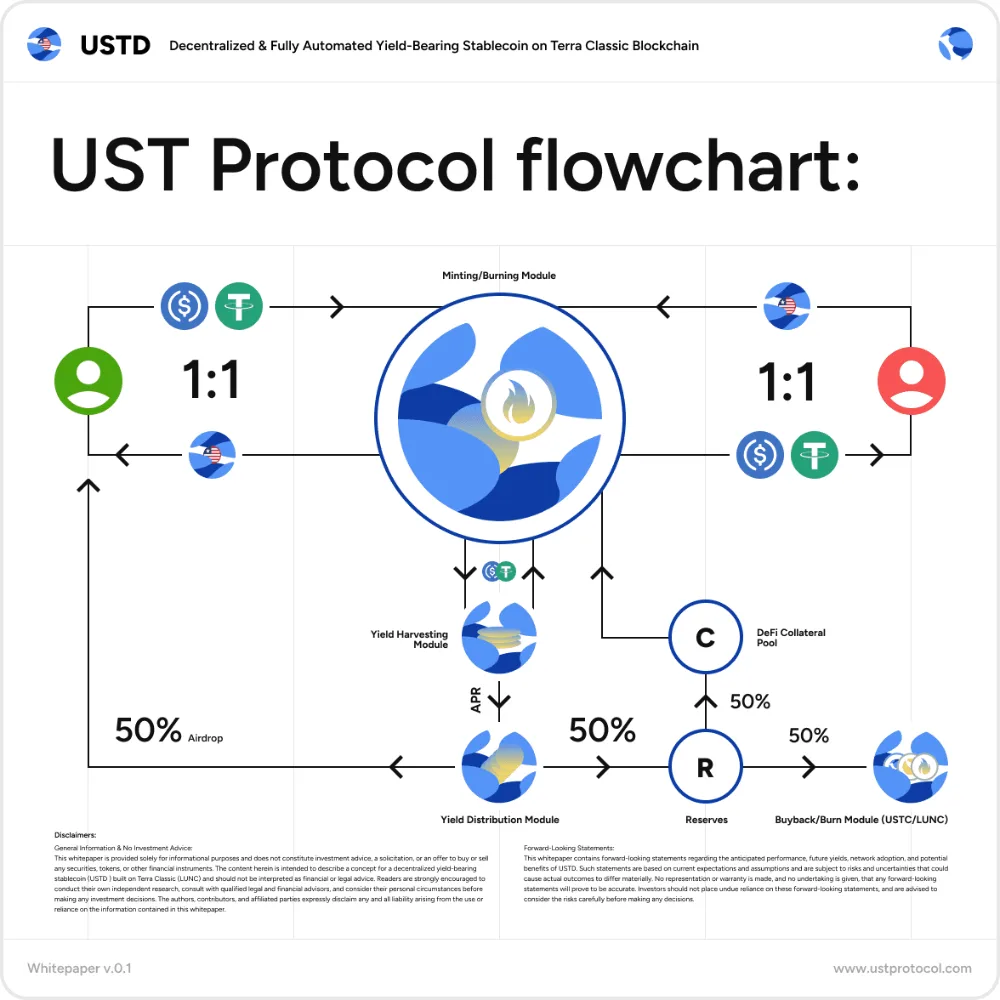

USTD is a next-generation stablecoin built directly on Terra Classic L1. Unlike previous attempts, USTD is conceived as a completely new stablecoin with additional long-term side goal of revitalizing USTC. It is designed not only to preserve a 1:1 peg with the US Dollar by being fully collateralized by fiat-backed stablecoins (USDC/USDT) but also to reward its holders with attractive yields—all delivered automatically through periodic airdrops.

USTD leverages Terra Classic’s high throughput, low fees, and robust governance framework (which governs all Terra Classic protocols) to offer a secure, transparent, and efficient solution for both retail and institutional investors.

Key Highlights:

Stable & Yield-Bearing:

• Every USTD token is minted 1:1 against USDC/USDT, and the deposited collateral is deployed into low-risk, high-liquidity decentralized pools. Approximately 20% APR (on average) is generated from these pools. Approximately 50% of the yield generated is distributed directly to USTD holders as regular on-chain airdrops.

Automatic Yield Distribution:

• Unlike many yield-bearing protocols that require additional staking, UST Protocol automatically distributes yield via regular on-chain airdrops.

Transition from USTC:

• USTD is introduced as a completely new stablecoin designed to fill the space of the currently defunct USTC. This initiative is both a fresh start with enhanced security, transparency, yield mechanics and profit generation for Terra Classic, but also in long run tool to revive USTC.

Integrated Governance:

• USTD is fully integrated into Terra Classic’s on-chain governance. All decisions, upgrades, and risk management measures affecting USTD are managed by Terra Classic Governance, ensuring alignment with the broader ecosystem.

Robust Security:

• By being fully backed with regulated assets and operating on Terra Classic L1, USTD benefits from enhanced security and transparent reserve management.

Compliance:

• USTD’s focus on yield and collateral keeps it outside the heavy “payment stablecoin” regime of the U.S. GENIUS and STABLE Acts, sparing the project costly bank‑style licensing. In Europe, MiCA applies only if USTD is publicly offered, and the protocol can tap that market by appointing a dedicated reporting entity while preserving its decentralized design. Until then, USTD remains freely usable across global DeFi, giving holders a secure, transparent, and regulator‑resilient asset.

Market Opportunity:

• Amid a rapidly evolving stablecoin and DeFi landscape, USTD addresses current shortcomings—including centralization risks and low yield—thus positioning itself as a compelling solution for a broad spectrum of users.

Vision & Mission:

Our vision is to redefine digital finance by providing a stable, yield-bearing asset that rewards holders automatically and operates in a fully decentralized, trustless environment. Our mission is to empower investors by creating an asset that offers both stability and effortless passive income—all governed under the established Terra Classic framework.

In addition, the UST Protocol, serving as the innovative engine behind USTD, is designed to complement Terra Classic’s existing Staking Protocol. By offering automated yield-bearing capabilities alongside the traditional staking mechanism, Terra Classic L1 will benefit from a dual-product ecosystem.

This synergy will provide users with both passive income through conventional staking and innovative stablecoin generating yield through automatic airdrops, enhancing overall network value and diversifying user engagement.

Further development:

Due to the complexity and scale of the project, the UST Protocol / USTD concept itself will be subject to change during the design process of the final solution, after, we hope, a positive decision from the Terra Classic community regarding implementation of the project.

Next steps:

In the next 2 weeks, a detailed proposal for the implementation of the UST Protocol / USTD will be presented and will be subject to a vote in the official Terra Classic governance