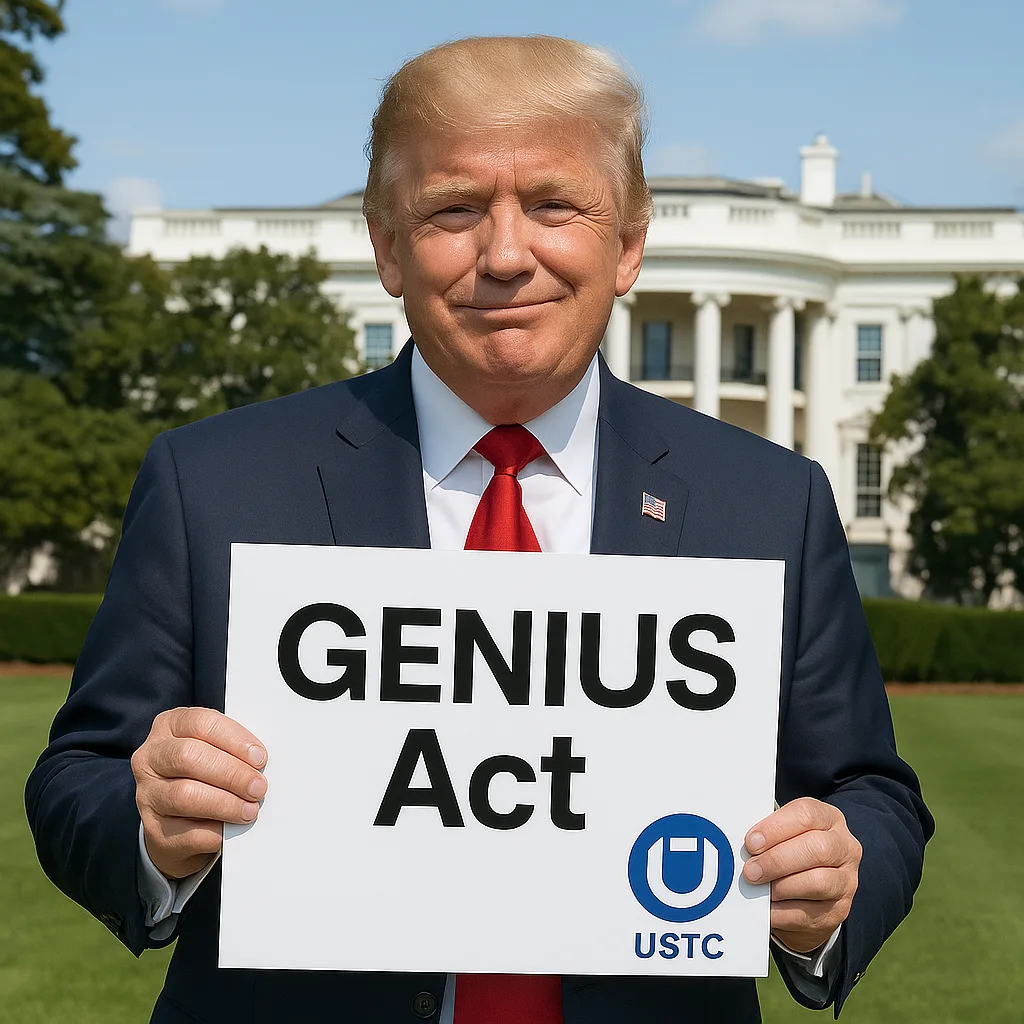

In a move that could redefine the future of digital finance, President Donald Trump has officially signed the GENIUS Act into law, establishing the first federal regulatory framework for stablecoins in United States history.

Passed with strong bipartisan support, the law represents a breakthrough moment for the crypto industry, creating clear standards for stablecoin issuance, reserves, and consumer protections. With the act now signed, the U.S. government is signaling its commitment to giving the digital dollar space a legal foundation.

What the GENIUS Act Means

The legislation requires that all U.S. dollar backed stablecoins be fully collateralized by high-quality liquid assets like cash or Treasury bills. Issuers must publish monthly reports and undergo annual audits. This aims to eliminate the kind of opaque practices that led to previous stablecoin failures.

A new licensing system will allow both federal and state regulators to approve stablecoin issuers. The Office of the Comptroller of the Currency (OCC), the Federal Reserve, the FDIC, and the National Credit Union Administration (NCUA) will now oversee stablecoin operations depending on the issuer’s structure.

Perhaps most critically, the law makes clear that stablecoins regulated under the GENIUS Act are not to be treated as securities or commodities. This effectively removes oversight by the SEC or CFTC and places the authority with banking regulators — a major win for fintech companies and payment platforms.

All issuers will be subject to anti-money laundering rules, KYC obligations, and must provide clear disclosures to customers. Misleading claims about federal backing or deposit insurance are now strictly prohibited.

Why the Timing Matters

The GENIUS Act comes at a time when global competition around digital currencies is intensifying. With other economies experimenting with central bank digital currencies, the U.S. is taking a market-driven approach. By enabling the private sector to build stablecoins under a federally approved framework, the U.S. dollar could maintain its global dominance in digital form.

Market response has been immediate. Bitcoin and major altcoins saw strong upward moves following the news. Analysts from Citigroup and Standard Chartered estimate the stablecoin market could surpass two trillion dollars by 2028 if the regulatory clarity leads to mainstream adoption by banks and corporations.

Major financial institutions including JPMorgan, Visa, and PayPal are already exploring GENIUS compliant stablecoins. Early signs suggest they view the new framework as a green light to enter the space more aggressively.

Critics Raise Red Flags

Not everyone supports the bill without reservations. Some lawmakers and watchdog groups have warned that the GENIUS Act could allow large private firms to issue stablecoins without sufficient democratic oversight. Others point out that President Trump could benefit financially from the legislation, given his connections to a USD1 branded stablecoin that launched earlier this year.

There are also concerns that tying stablecoin backing to the Treasury market could add systemic risk, particularly if large issuers trigger liquidity crunches by offloading assets quickly during market stress.

What Happens Next

Federal agencies now have 180 days to finalize the regulations, with the law going into full effect as early as the end of 2025. If implementation proceeds as planned, the U.S. will become the most stablecoin-friendly major economy in the world.

In practical terms, consumers could soon be using digital dollars issued by regulated banks or fintech apps with the same confidence as traditional bank deposits.

The GENIUS Act may be remembered as the moment the United States stopped debating crypto and started leading it.