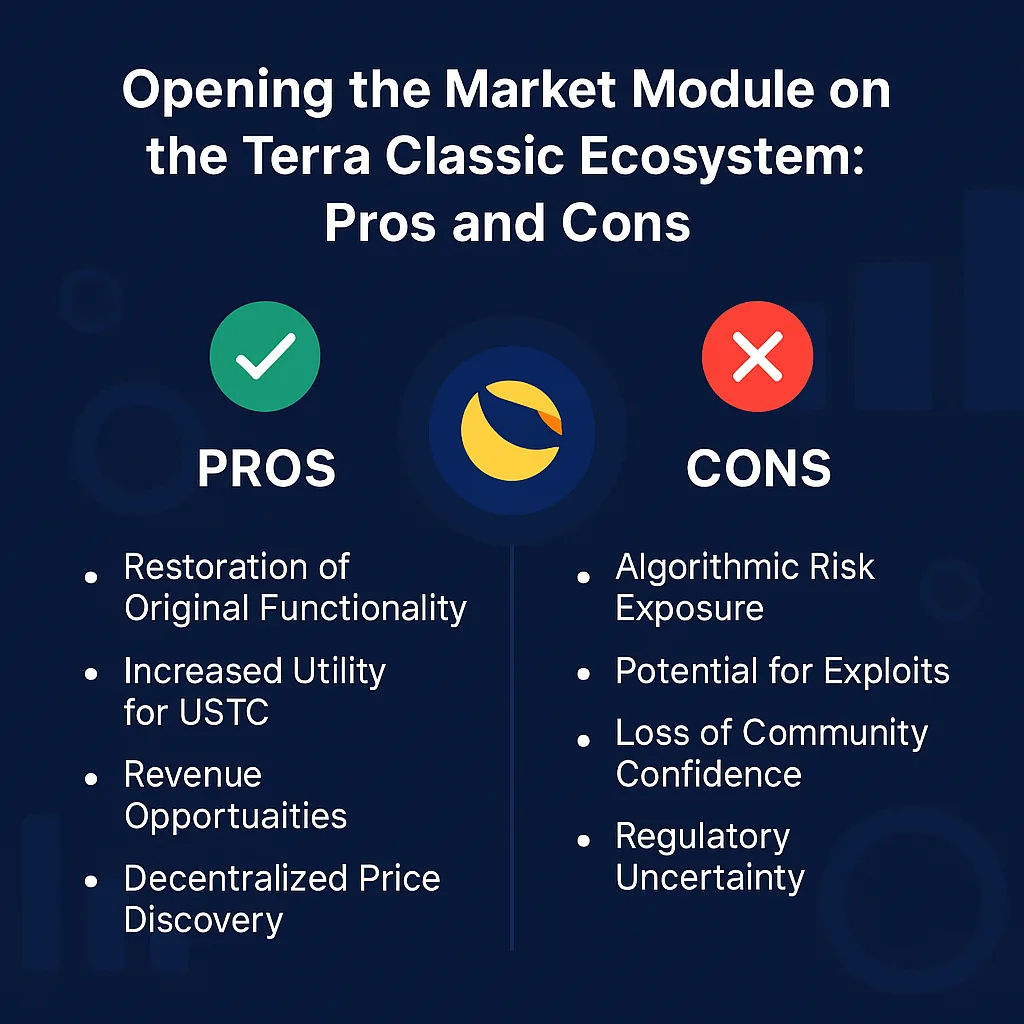

The Terra Classic community has been actively exploring ways to restore functionality and attract utility to its blockchain. One proposal gaining traction is reopening the Market Module, which enables on-chain swaps between LUNC and USTC at algorithmic rates. While this move could unlock new opportunities, it also carries notable risks.

Pros

- Restoration of Original Functionality

Reopening the Market Module would restore core functionality to the Terra Classic blockchain, aligning it more closely with its original design. This could signal maturity and progress to developers and investors. - Increased Utility for USTC

Reactivating on-chain swaps could revive demand for USTC, offering it a clearer use case beyond speculative trading. Increased utility may also encourage further integration in DeFi projects. - Revenue Opportunities

Swaps and arbitrage trading may generate fee income for the community pool, which can be reinvested into development, staking rewards, or other ecosystem incentives. - Decentralized Price Discovery

On-chain swaps would help establish a decentralized, transparent pricing mechanism for USTC, independent of centralized exchanges.

Cons

- Algorithmic Risk Exposure

The original depeg of USTC was a result of flaws in the algorithmic model. Reopening the Market Module without robust safeguards may reintroduce systemic risk. - Potential for Exploits

If market parameters aren’t properly calibrated, arbitrageurs could exploit price discrepancies, draining liquidity and harming small users. - Loss of Community Confidence

A failed reimplementation could damage trust further. Without a clear redemption or stabilization mechanism, the risk of another depeg event looms. - Regulatory Uncertainty

Reintroducing an algorithmic stablecoin mechanism might attract regulatory scrutiny, particularly in jurisdictions sensitive to stablecoin risks.

Conclusion

While the Market Module offers potential to revitalize Terra Classic, its reactivation must be handled with extreme care. A community-wide consensus, comprehensive testing, and risk management frameworks are essential before moving forward.