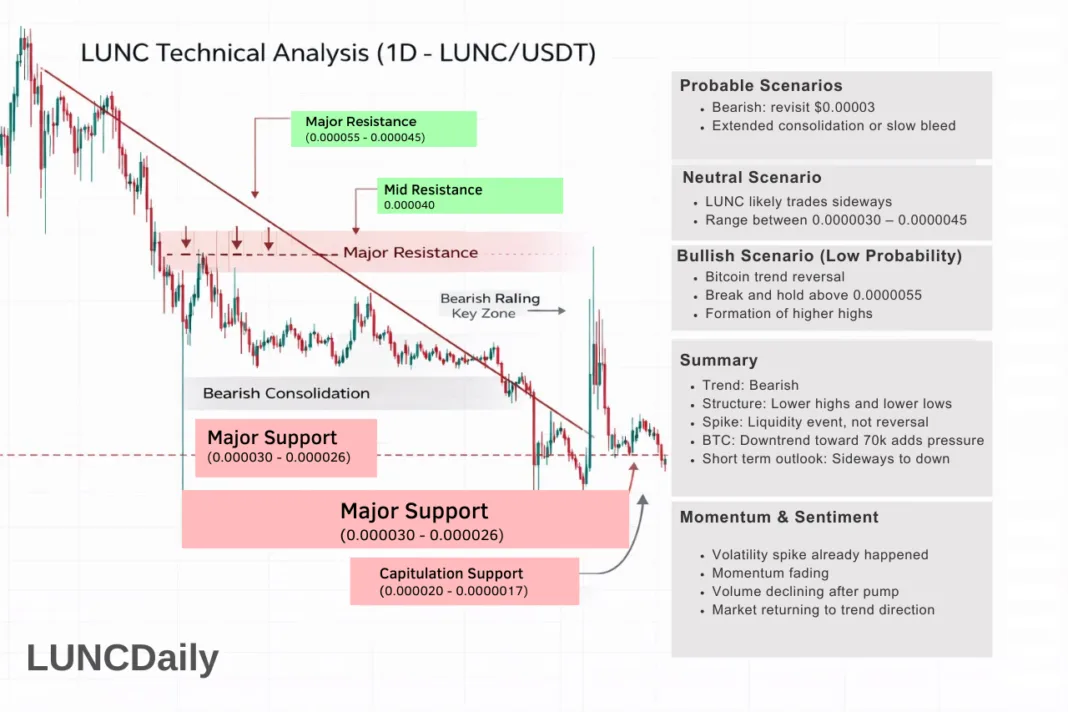

LUNC Technical Analysis (1D – LUNC/USDT)

Market Context

Before analyzing LUNC itself, we must start with Bitcoin.

Bitcoin’s daily structure is currently in a downtrend with price moving toward the 70,000 USD region. Historically, when Bitcoin trends down or shows weakness:

- Liquidity leaves altcoins first

- Altcoins underperform Bitcoin

- Relief rallies on altcoins tend to be short lived

This macro pressure is clearly visible in the LUNC chart.

LUNC Market Structure

Primary Trend

LUNC remains in a clear long term downtrend.

- Series of lower highs

- Series of lower lows

- Repeated rejection from resistance zones

- No confirmed higher high on the daily timeframe

The large spike on the right side of the chart appears to be a news driven liquidity spike rather than a trend reversal. A single vertical pump does not change market structure.

Large Wick Event (Capitulation and Short Squeeze)

The chart shows two extreme candles:

- A sharp liquidation wick downward

- Immediately followed by a vertical pump

This typically signals massive liquidations and a short squeeze. After such events, markets usually enter consolidation or continue the main trend. Price quickly returned to sideways to downward movement, confirming this behavior.

Current Price Behavior

- Price failed to hold the highs

- Lower highs started forming again

- The market moved into bearish consolidation

This shows buyers lack follow through. In simple terms, buyers reacted to news but are not strong enough to sustain a trend.

Key Levels

Major Resistance: 0.000045 – 0.000055

- Previous support turned resistance

- Post spike rejection zone

- Sellers consistently appear here

LUNC must break and hold above this zone to start a bullish reversal discussion.

Mid Resistance: 0.000040

This is the current rejection area where price repeatedly fails, confirming weak momentum.

Major Support: 0.000030 – 0.000026

This is the most important level on the chart. If Bitcoin continues toward 70,000, this support becomes the primary downside target.

Capitulation Support: 0.000020 – 0.000017

This is the extreme liquidity zone from the long wick. If market risk increases, price often revisits these liquidity areas.

Momentum and Sentiment

- Volatility spike already occurred

- Momentum is fading

- Volume declined after the pump

- Market is returning to the main trend direction

This reflects classic bear market rally behavior.

Correlation with Bitcoin

Because Bitcoin is trending down toward 70,000, expected altcoin behavior includes:

- Lower liquidity

- Failed breakouts

- Range breakdown risk

- Gradual price decline

Upside moves may still occur short term, but they are likely temporary until Bitcoin stabilizes.

Probable Scenarios

Bearish Scenario (Higher Probability)

- LUNC revisits 0.000030

- Possible sweep of 0.000026 liquidity

- Extended consolidation or gradual decline

Neutral Scenario

- If Bitcoin stabilizes near 70,000

- LUNC trades sideways between 0.000030 and 0.000045

Bullish Scenario (Low Probability)

- Requires Bitcoin trend reversal

- Break and hold above 0.000055

- Formation of higher highs

Summary

- Trend: Bearish

- Structure: Lower highs and lower lows

- Spike: Liquidity event, not reversal

- Bitcoin trend adds pressure

- Short term outlook: Sideways to down