Technical Analysis of Terra Luna Classic (LUNC) – May 15, 2025

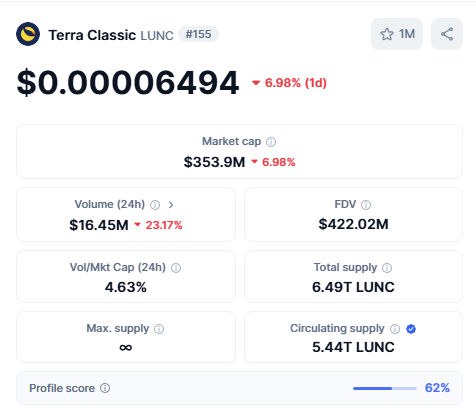

As of May 15, 2025, Terra Luna Classic (LUNC) trades around $0.000067, reflecting a -1.08% change over the past 24 hours, with a market cap of approximately $373.36M and a circulating supply of 5.44 trillion tokens. The price remains range-bound, oscillating between $0.000059 and $0.0000645, indicating a consolidation phase.

Price Action and Patterns: LUNC exhibits a horizontal channel pattern, characterized by parallel upper (resistance) and lower (support) trendlines. Resistance is observed near $0.0000645-$0.000067, while support holds at $0.000059-$0.000060. A breakout above $0.000067 could target $0.000071, whereas a drop below $0.000059 may push prices toward $0.000056.

Technical Indicators:

- Moving Averages: The 50-day SMA ($0.00006178) trends slightly above the current price, signaling short-term bearish pressure. The 200-day SMA ($0.00007409) suggests a longer-term downtrend, with LUNC trading below both averages.

- Relative Strength Index (RSI): On a 14-day timeframe, RSI hovers around 30-40, indicating neutral to slightly oversold conditions. This suggests potential for a bounce if buying pressure increases, but no strong momentum exists.

- Volume: Daily trading volume (~$9.5M-$10.2M) remains low, reflecting subdued market activity, which supports the consolidation narrative.

Sentiment and Outlook: The Fear & Greed Index shows “Greed” at 67, hinting at cautious optimism. However, technical indicators lean neutral, with 19 bullish and 13 bearish signals. A token burn program, reducing supply by over 408 billion LUNC, could support long-term upside if sustained. Short-term, LUNC may remain range-bound unless a catalyst drives volume and a breakout.

Conclusion: LUNC is in a consolidation phase with neutral momentum. Traders should monitor $0.000059 support and $0.000067 resistance for potential breakout signals, while long-term investors may consider token burn impacts. Always conduct independent research due to crypto volatility.