Bitcoin Market Analysis (BTCUSD 1D)

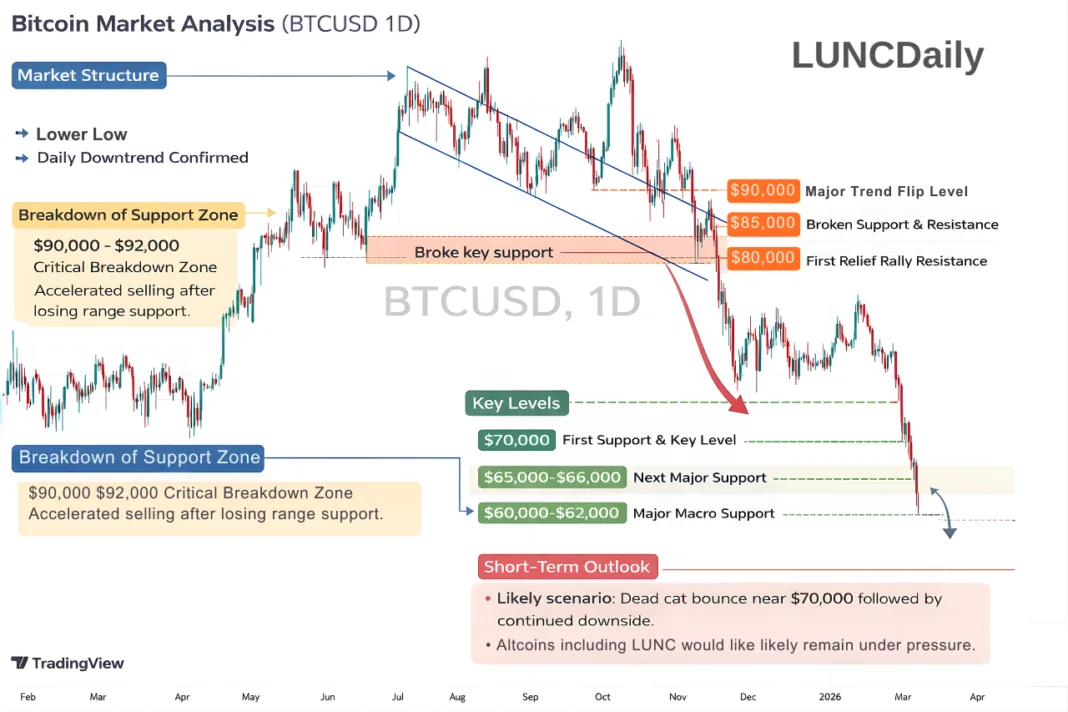

Market structure

Bitcoin has confirmed a major trend reversal on the daily timeframe.

After printing a cycle high near 124000 to 125000, price formed a lower high, a lower low, and then broke key support.

This confirms a daily downtrend structure.

The recent move is not a normal pullback. It is a capitulation leg.

What just happened on the chart

The most important event is the loss of the 90000 to 92000 support zone.

This level previously acted as range support in December and a bounce zone multiple times.

Once this level broke, sellers accelerated and we saw a vertical liquidation drop toward 70000.

This type of move usually indicates long liquidations, panic selling, and a shift from bullish to bearish momentum.

Current momentum

Recent candles show large bearish bodies and little bullish follow through.

Price is closing near daily lows, which means sellers still control the market.

There is no confirmed bottom yet.

Key support levels

- 70000 zone. First reaction support and high volatility area.

- 65000 to 66000. Previous consolidation zone and strong demand area.

- 60000 to 62000. Major macro support and full correction territory.

Key resistance levels

- 80000. First relief rally resistance.

- 85000. Broken structure resistance.

- 90000. Major trend flip level.

Only a reclaim above 90000 would weaken the bearish outlook.

Short term outlook

The most likely scenario is a temporary bounce near 70000 followed by continued volatility and retests.

The market is shifting from euphoria to fear.

This does not end the bull cycle, but it confirms a mid cycle correction.

LUNC Analysis

Current price: 0.000036 USD

Market context

When Bitcoin enters a strong correction, altcoins usually drop faster, recover slower, and lose liquidity.

LUNC historically has high correlation with Bitcoin, which means it moves more aggressively during market stress.

LUNC market structure

LUNC is currently in a macro downtrend continuation phase.

Bitcoin weakness removes retail momentum and speculative liquidity, which directly impacts LUNC.

Key support levels

- 0.000034 to 0.000032. Immediate support zone and possible bounce area.

- 0.000028. Strong historical support if Bitcoin drops toward 65000.

- 0.000022 to 0.000025. Panic zone if Bitcoin approaches 60000.

Resistance levels

- 0.000042. First trend resistance.

- 0.000048. Structure reclaim level.

- 0.000055. Momentum return zone.

Outlook

Short term, expect volatility and downside pressure with possible relief bounces.

Medium term recovery for LUNC will likely begin only after Bitcoin finds a stable bottom.

Summary

- Bitcoin has entered a confirmed daily downtrend.

- 70000 is the first major support but the bottom is not confirmed.

- Altcoins including LUNC will likely remain under pressure.

- LUNC may test lower supports if Bitcoin continues correcting.

- This is a correction phase, not the end of the crypto cycle.