Is a Coordinated Narrative Attacking Crypto? Market Drop Sparks Speculation

In recent days, the crypto market has faced a wave of negative narratives circulating across social platforms. Bitcoin and the broader crypto market experienced a sharp decline, with Bitcoin falling to levels not seen in years. What makes this situation unusual is the absence of major fundamental or economic announcements that typically trigger moves of this scale.

This has led some market observers to question whether the sudden surge of negative narratives is coincidental or part of a coordinated effort to damage crypto sentiment.

A Sudden Shift in Online Narratives

Over a short period, several controversial claims about the crypto industry began spreading online. Many of these claims were shared by unknown or newly created accounts using similar messaging. While none of these claims have been supported by credible evidence, their rapid spread has contributed to growing uncertainty and fear in the market.

Claim One: Speculation About Bitcoin’s Creator

One widely circulated claim suggests that Satoshi Nakamoto, the creator of Bitcoin, was connected to Jeffrey Epstein. This narrative began circulating shortly after renewed public discussion around Epstein-related documents. However, no official or verified source has confirmed any connection between Epstein and Bitcoin’s creation.

Despite the lack of evidence, the narrative quickly gained traction online and contributed to negative sentiment toward the crypto space.

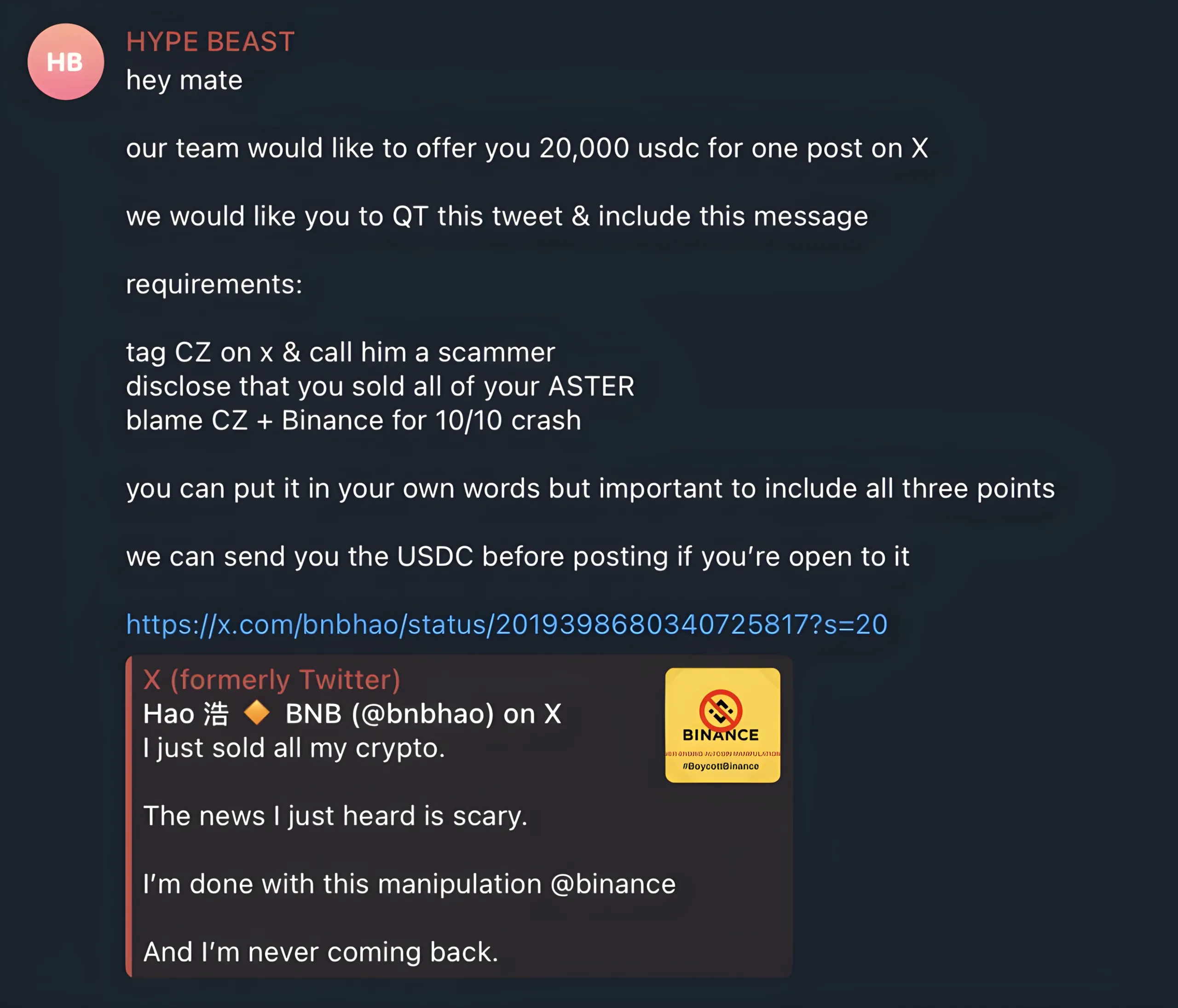

Claim Two: Accusations Targeting Binance and CZ

Another narrative focused on allegations that Binance and its former CEO Changpeng Zhao were responsible for manipulating the crypto market. These claims were often shared without verifiable proof and in some cases accompanied by alleged leaked or fabricated documents.

The rapid spread of these accusations has raised concerns about misinformation campaigns and the potential impact of false claims on public trust in the industry.

Lack of Major Economic Catalysts

Market participants typically expect large crypto price movements to follow significant macroeconomic events or major regulatory announcements. In this case, no major economic developments were reported that would normally explain such a sharp decline.

While discussions about a potential government shutdown appeared in the news cycle, there were no clear economic triggers that historically correlate with a major drop in Bitcoin’s price.

Market Sentiment and Uncertainty

The combination of negative narratives and the absence of clear economic catalysts has fueled speculation about whether the crypto market is facing an organized attempt to damage its credibility.

At this stage, there is no confirmed evidence of a coordinated campaign. However, the situation highlights how quickly sentiment can shift when misinformation spreads across social media and online communities.

For investors and observers, the key takeaway is the importance of verifying information and focusing on credible sources before drawing conclusions. The crypto market has experienced many periods of uncertainty, and sentiment driven by rumors can often amplify volatility.