Altcoins Face Historic Selling Pressure as Capital Rotates to Bitcoin: What It Means for Terra Classic (LUNC)

Altcoins Under Extreme Selling Pressure

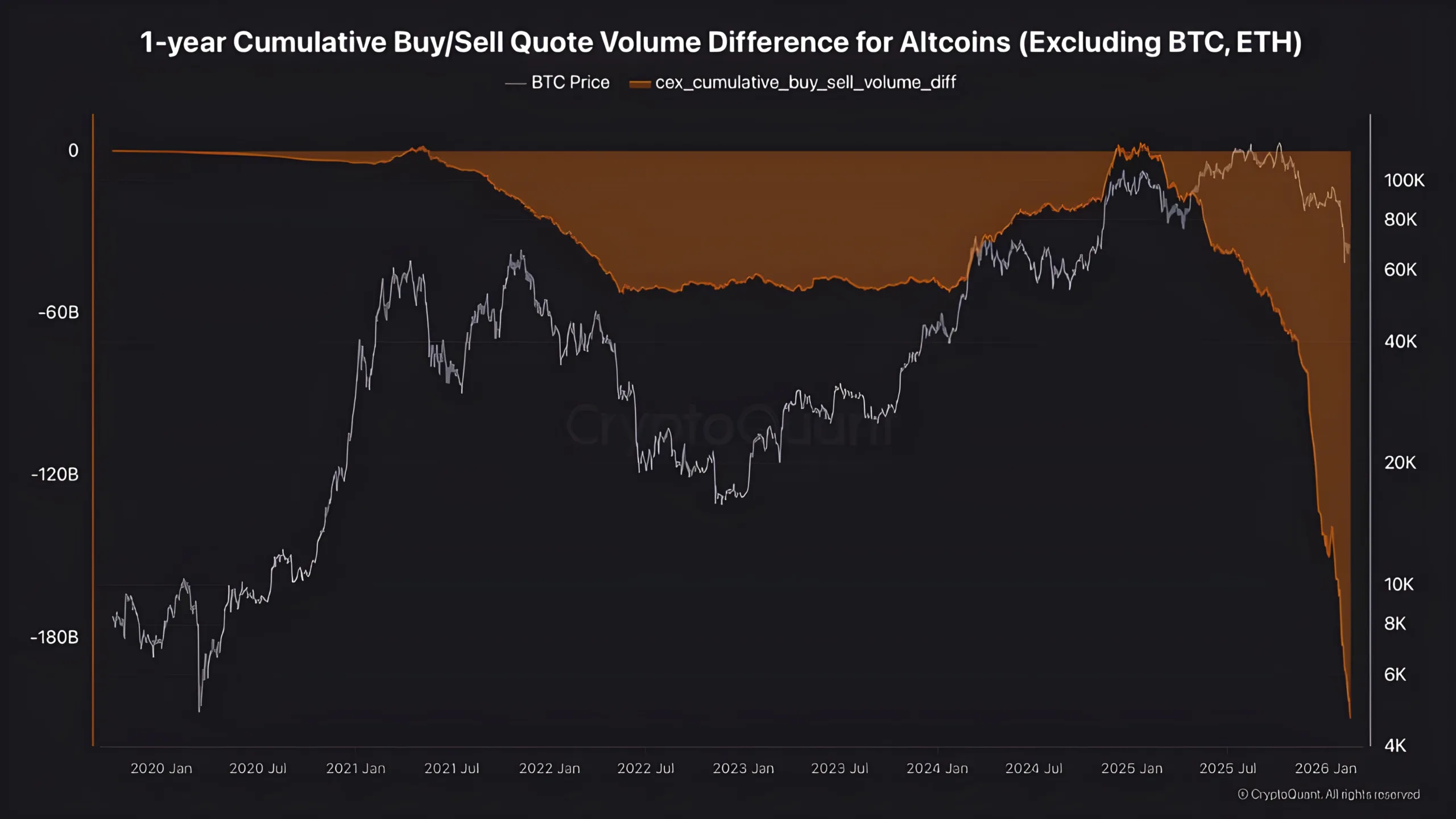

Recent CryptoQuant data shows that the one year cumulative buy and sell volume difference for altcoins excluding Bitcoin and Ethereum has dropped to negative 209 billion dollars since January 2025. This means more than 209 billion dollars worth of altcoins have been sold compared to bought over the past year.

This level of selling pressure is three times worse than what the market experienced during the 2022 FTX collapse. The data signals a major shift in investor behavior across the crypto market.

Altcoin trading volumes have also been cut in half, confirming that interest and liquidity in the sector have significantly weakened.

Why Capital Is Leaving Altcoins

The data highlights three major market trends.

First, retail investors are exiting altcoins. Smaller investors tend to hold higher risk assets during bullish periods, but when uncertainty increases they often move funds to safer assets or leave the market entirely.

Second, capital is rotating toward Bitcoin around the 68000 dollar level. This is a classic risk off behavior where investors prioritize the most established and liquid asset in the crypto market.

Third, institutional buying of altcoins remains limited. Without large buyers stepping in, altcoins struggle to absorb selling pressure and maintain upward momentum.

As a result, Bitcoin dominance has climbed to 58 percent, meaning Bitcoin now represents a larger share of the total crypto market value while altcoins lose relative strength.

What This Means for Altcoin Investors

Historically, rising Bitcoin dominance signals a defensive phase in the crypto cycle. During this period:

- Investors prefer safety and liquidity

- Risk appetite decreases

- Altcoins often underperform or decline

However, the data also shows early technical signals that selling pressure may be slowing. Traders have identified a rare MACD crossover and RSI breakout on the altcoin to Bitcoin ratio. These signals sometimes appear when sellers are becoming exhausted.

This does not guarantee an immediate recovery, but it suggests the market may be approaching a late stage of the selling cycle.

Focus on Terra Classic (LUNC)

Terra Classic is part of the broader altcoin market and is directly affected by these macro trends.

Current LUNC price: 0.000034 dollars

Why LUNC Is Impacted More Than Large Altcoins

LUNC depends heavily on retail participation, community activity, and speculative demand. When retail investors leave the altcoin market, smaller and mid cap tokens typically feel the impact first.

Reduced altcoin volume means:

- Less speculative trading

- Lower liquidity

- Slower price recovery potential

This explains why many altcoins struggle during periods of rising Bitcoin dominance.

Realistic LUNC Price Projection

Short Term Scenario 2025

If altcoin selling pressure continues and Bitcoin dominance remains high:

Likely range: 0.000020 to 0.000040

This range reflects continued consolidation and weak demand while the market remains defensive.

Neutral Recovery Scenario

If seller exhaustion signals lead to stabilization and gradual return of demand:

Possible range: 0.000040 to 0.000080

This would require improving altcoin sentiment and renewed retail participation.

Bullish Altcoin Rotation Scenario

If capital rotates back from Bitcoin into altcoins:

Potential range: 0.000080 to 0.000150

This scenario depends on:

- Strong altcoin inflows

- Increasing market liquidity

- Declining Bitcoin dominance

This would represent a full altcoin cycle recovery rather than an isolated LUNC rally.

Key Takeaways

The crypto market is currently in a Bitcoin focused phase. Altcoins are experiencing one of the largest selling waves in recent history, driven by retail exits, limited institutional buying, and reduced trading volume.

Early technical signals suggest selling pressure may be nearing exhaustion, but a sustainable recovery requires new demand and fresh capital entering the altcoin market.

For Terra Classic, the most realistic outlook is a period of consolidation followed by gradual recovery once broader altcoin momentum returns.