Introduction

On chain trading volume plays a major role in the growth of the Terra Classic ecosystem. Every on chain transaction contributes to the daily LUNC burn through the network tax. Because of this, increasing on chain activity is often seen as a key driver for long term sustainability and supply reduction.

However, the cost of trading LUNC on chain has become a growing concern. High transaction tax combined with slippage caused by low liquidity creates a significant barrier for traders and large investors. This raises an important question for the community. Should solving this problem become a priority?

Why On Chain Volume Matters

The Terra Classic network relies heavily on on chain activity. More trading volume means:

- Higher daily LUNC burn from transaction tax

- Stronger ecosystem utility

- Increased liquidity and market confidence

Centralized exchange trading does not contribute to daily burn. Platforms such as Binance run a separate monthly burn program funded by their trading fees. This means on chain volume is the only consistent daily driver of LUNC burn.

The Real Cost of Buying LUNC On Chain

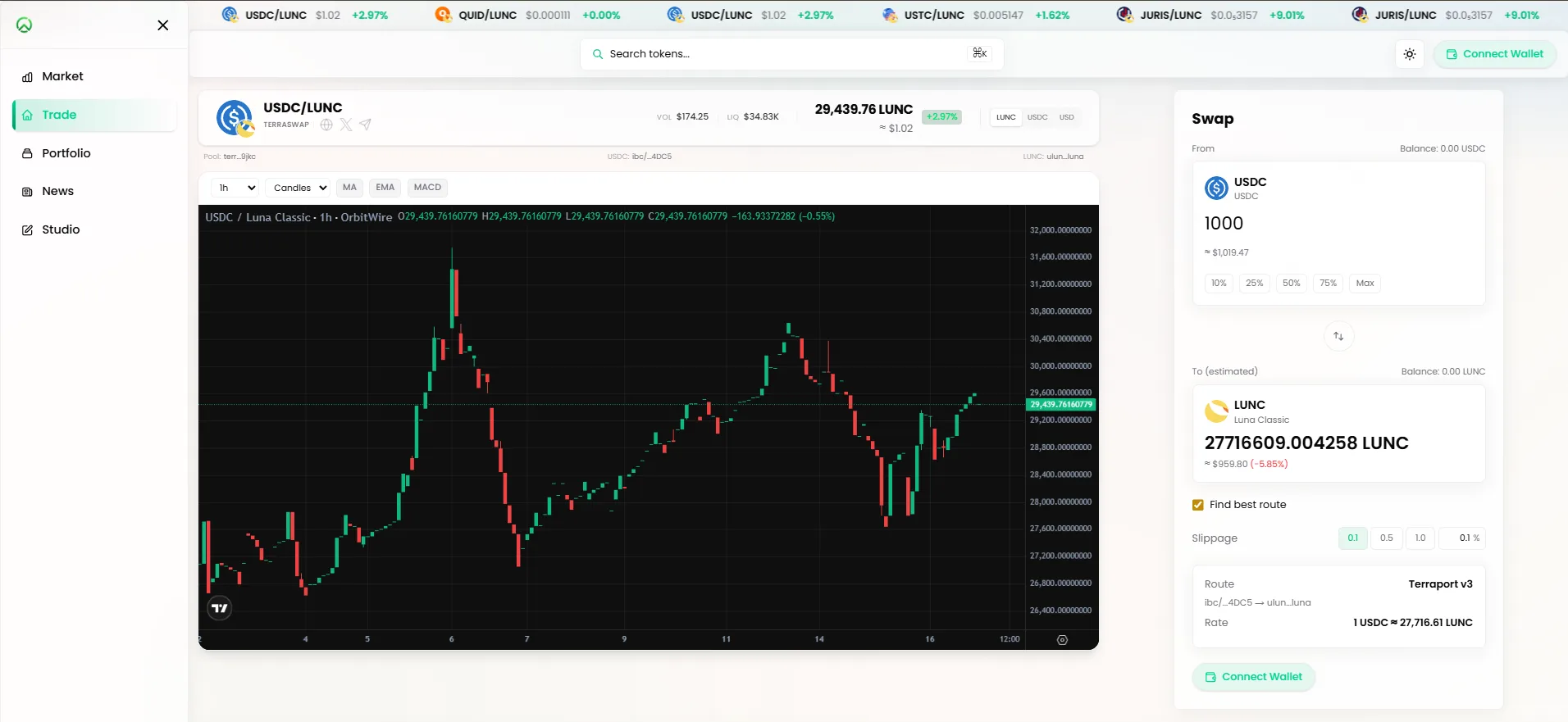

Using the example from the swap interface

- Trader wants to buy 1,000 USDC worth of LUNC

- Due to tax and price impact, the final value received is approximately 959.80 USDC worth of LUNC

- This represents a loss of about 40.20 USDC in a single trade

- The effective reduction shown is about 5.85 percent

- And this does not include the cost of DEX fees.

This means a trader immediately starts at a significant loss before any market movement even occurs.

Tax Plus Slippage Creates a Major Barrier

Two main factors make on chain LUNC trading expensive.

Transaction Tax

Every trade includes a 0.5 percent on chain tax. While this helps burn supply, it increases entry costs for investors.

Low Liquidity and Slippage

Because liquidity is limited, larger trades move the market price. This creates slippage, which further reduces the value received during swaps.

When combined, these costs can exceed 5 percent for a single transaction.

Why This Discourages Whales

Large investors are extremely sensitive to trading costs. Entering or exiting positions with a built in loss of several percent makes the asset less attractive compared to alternatives with deeper liquidity and lower fees.

- Liquidity grows slowly

- Market momentum remains limited

- Price growth becomes more difficult

This creates a cycle where high costs reduce participation and low participation keeps liquidity weak.

A Community Level Challenge

Terra Classic is a decentralized blockchain driven by its community. If on chain trading remains expensive, the ecosystem may struggle to attract new capital and increase daily burn through higher volume.

This does not mean the burn mechanism is wrong. It means the balance between burn, liquidity, and accessibility may need to be revisited.

Conclusion

On chain trading is essential for Terra Classic growth, but the current cost structure creates friction for traders and large investors. A 1,000 USDC swap losing roughly 40 USDC in value highlights a real and measurable problem.

If the community wants stronger adoption, deeper liquidity, and increased daily burn, addressing on chain trading costs may become one of the most important discussions moving forward.