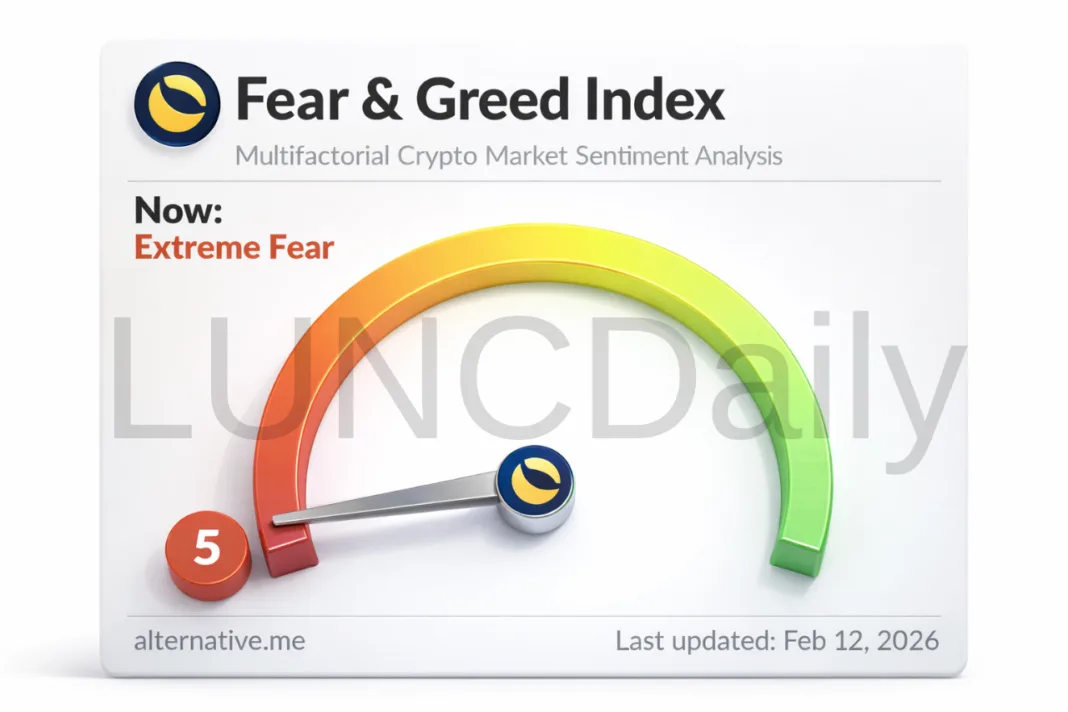

Crypto Fear and Greed Index Falls to Level 5. What Extreme Fear Means for the Market

The Crypto Fear and Greed Index has dropped to a level of 5, marking one of the lowest readings in its history. This level is widely considered extreme fear and signals a market environment driven by strong negative sentiment.

Such conditions are often associated with market capitulation rather than a simple bearish phase.

Understanding Extreme Fear in Crypto Markets

Extreme fear does not automatically predict a market reversal. However, historically, periods of intense fear have often appeared near local market bottoms. This happens because market positioning changes dramatically during sharp declines.

When sentiment becomes overwhelmingly negative, many investors have already sold their positions. This process removes weaker participants from the market and reduces selling pressure over time.

At this stage, the market is no longer dominated by panic selling. Instead, it begins to shift toward a more balanced risk and reward environment.

Why Capitulation Matters

When most participants expect prices to fall further, two important dynamics typically emerge.

First, weak hands have largely exited the market. These participants are usually more reactive to volatility and are quicker to sell during uncertainty.

Second, the overall risk and reward profile quietly improves. With fewer sellers left, the potential downside may decrease while the upside becomes more attractive for long term investors.

This does not mean prices will immediately rise. It means the market structure begins to change beneath the surface.

Sentiment Is Not a Trading Signal

It is important to understand that sentiment alone is not a trading signal. The Fear and Greed Index provides context, not direction.

The key question is what is driving the current fear.

Is it the result of tightening global liquidity and macroeconomic pressure, or is it driven by short term volatility and market noise?

The answer to this question determines whether the fear reflects deeper structural risks or a temporary emotional reaction.

The Bigger Picture

The Fear and Greed Index should be viewed as a backdrop for market analysis rather than a standalone indicator. It helps investors understand how the market feels, but not necessarily what the market will do next.

Extreme fear highlights stress within the system, but it also signals that much of the negative positioning may already be in place.

As always, sentiment should be combined with macro trends, liquidity conditions, and technical analysis to build a complete market view.